Business Financial Planning

Business owners are so busy being successful that they have little or no time to look at those things that impact their own finances.

We all have a plan…..either by DESIGN or by default…and having worked with thousands of businesses over the years, we find that most owners have five concerns in common:

- How do I increase cash flow?

- If cash flow is good, then taxes become an issue

- How do I get full value out of my business if I retire, pass away or become disabled and cannot work any longer?

- How do I reward and retain my key, critical and most valuable employees so they stay with me for the long haul?

- How do I build personal net worth?

Our advisors look over your situation and explore the potential options and strategies available to help you build personal net worth using business dollars in the most tax-efficient way possible.

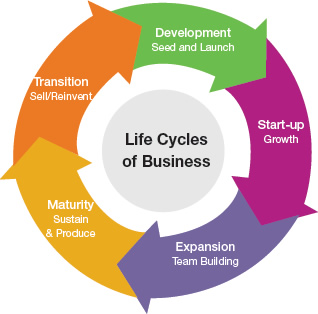

The Business Life Cycle

Your business cash flow dictates how you plan for your business’ future.

Business Succession Planning

Goals

- Orderly transition of business

- Create certainty

- Value is pre-determined

- Tax efficiency

- Avoid liquidation upon a death or disability

- Create a market for the business (buyer)

- Obtain full value for heirs

The Result

- Creates a market for the business

- Assists you in valuing your business

- Creates certainty for employees, customers, suppliers, etc.

- Implementation of a buy-out agreement

Click here to see a sample business evaluation

* This is a legal document and must be prepared by a lawyer.

Retirement Plan Design

Business Owners:

Business owners interested in sponsoring a retirement plan can work with one of our consultants to design a plan specific to their needs. The types of plans implemented are 401K’s, Profit Sharing Plans, SEP IRA’s, Simple IRA’s, Deferred Compensation and Defined Benefit Plans.

Employees:

We educate your employees on the benefits retirement plans have to offer, either in a group setting or in an individual meeting.

- Income Analysis – Calculating one's future retirement income needs is in large part based on inflation, projected interest rates and life expectancy. The goal is to calculate current monthly savings needed to provide the income you desire at retirement.

- Tax Efficiency – Developing efficient tax strategies. Since there are a variety of plans, which plan is right for you? Some of these plans include 401k, SEP IRA, Simple IRA, IRA, Pension and Profit Sharing Plans.

- Investments – Which investments are right for you? We analyze mutual funds, stocks, bonds, limited partnerships and real estate to find which are the most appropriate investments for your risk tolerance.

Executive and Key Employee Benefits

Goals:

- Reward and Retain Key Employees

- Use Business Dollars to create personal net worth

- Make it expensive for employees to leave

Key Employee Retention Planning

Goals

- Key employees

- Recruit proven performers

- Thank key employees for their contributions

- Selectively reward and motivate key people

Advantages to Employer . . .

- Retains and attracts key employees

- Makes it expensive for employees to leave

Advantages to Key Employee . . .

- Substantial retirement/survivor benefits at little or no cost

- Frees up savings for other needs

Financial Calculators

Link Disclosure: The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites you are linking to.